The "Unfreezing" of the North Atlanta Market

While national news cycles alternate between talk of a "crash" and a "correction," the data for North Fulton and South Forsyth tells a story of incredible resilience. As we enter Q1 2026, we are witnessing a "Housing Reset"—a shift toward a more balanced, predictable market where both buyers and sellers can finally plan with confidence.

Why 2026 is Different (The Data)

The National Association of Realtors (NAR) predicts an 11% to 14% surge in sales volume this year. Locally, we saw this momentum begin in December 2025:

- Alpharetta saw a 19.81% increase in homes sold compared to the previous year.

- Milton median prices hit $1,607,500, a record-shattering 16.91% jump.

- Johns Creek remains a primary pillar of stability, with median prices reaching $775,000, a steady 3.1% increase that signals long-term equity security.

December Median Sales Price Comparison (2023–2025)

Pricing in Alpharetta, Milton, and Johns Creek continues to outperform national trends.

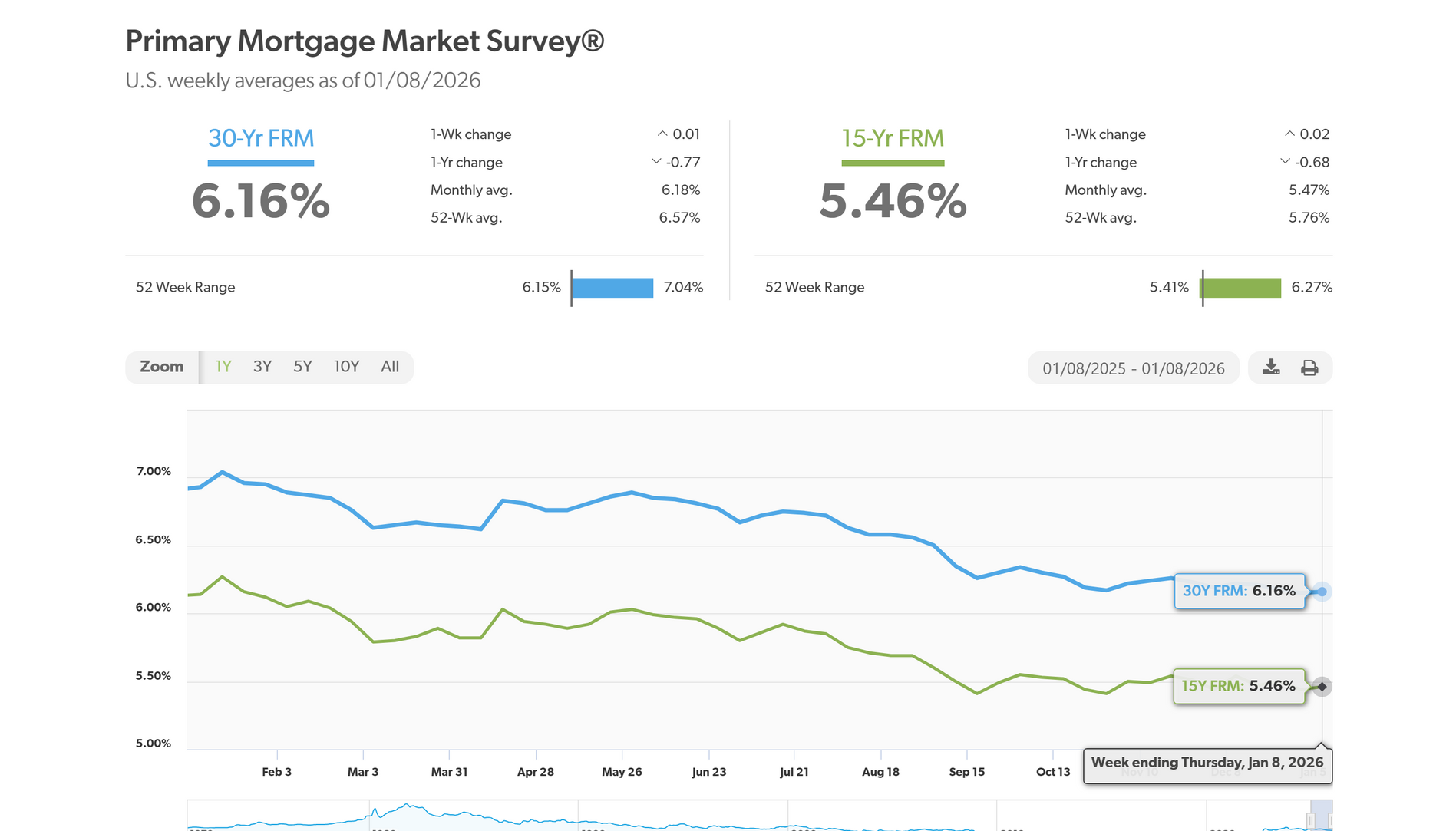

The 6.15% Green Light

For three years, the "lock-in effect" kept sellers from moving. With mortgage rates predicted to stabilize around 6% to 6.3% in 2026, the psychological barrier has broken. Buyers who sat on the sidelines are returning, but they are more data-driven and deliberate than before, treating their home purchase as the high-stakes financial investment it is.For three years, the "lock-in effect" kept sellers from moving. With mortgage rates predicted to stabilize around 6% to 6.3% in 2026, the psychological barrier has broken. Buyers who sat on the sidelines are returning, but they are more data-driven and deliberate than before, treating their home purchase as the high-stakes financial investment it is.

Mortgage rates are stabilizing, improving buyer confidence.

The Hard Truth: Inventory is Not a "Crash"

You may hear that inventory is "exploding"—and while it is rising—contextual data is key. In Alpharetta, inventory is up 43.10%, but our "Months of Supply" remains well below the 6 months required for a true "balanced" market. We aren't seeing a crash; we are seeing a return to choice for the consumer. Conversely, high-demand pockets like Sandy Springs saw inventory drop by 43.28%, proving that the market is hyper-local.

Despite rising listings, most North Atlanta markets remain undersupplied.

Get the 2026 North Atlanta Market Report

The North Atlanta housing market is showing strength and balance in 2026 — especially in Alpharetta, Milton, and Johns Creek — even as national headlines talk about corrections. This exclusive Q1 2026 Market Report and Neighborhood Value Map give you local data, trend insights, and opportunity areas that most buyers and sellers never see.

Click below to access the full report and value map.

The 2026 Neighborhood Value Map

This visual report complements the Q1 2026 Market Report with a neighborhood-by-neighborhood snapshot of performance across North Atlanta — highlighting equity growth zones, stabilized luxury segments, and buyer opportunity areas.

Watch: 2026 North Atlanta Housing Market Forecast

For a deeper breakdown of the trends shaping the North Atlanta housing market in 2026, watch the video below. This forecast expands on pricing, inventory shifts, and mortgage-rate stabilization—and explains what these changes mean for your home equity and next move in Alpharetta, Milton, Johns Creek, and surrounding communities.